Gst Rate On Ac Repair Service

The above result is only for your reference. SAC code - 9987 Maintenance repair and Installation except Construction - GST Rate 18.

Sac Services Accounting Codes List Gst Rates On Services

Maintenance and repair services of other machinery and equipments GST RATE ON SAC CODE - 998719 IS 18 Services Accounting Codes SAC Codes 998719 is used for the Maintenance and repair services of other machinery and equipments under.

Gst rate on ac repair service. These do not change the character of the goods. You can search GST tax rate for all products in this search box. Maintenance repair and installation except construction services.

We already know that the GST slabs are pegged at 5 12 18 28. Nil 2 Services by way of transfer of a going concern as. GST on Loans and Advances Earlier Service Tax was levied on Loans which has now been replaced by GST which would now be levied on loans.

Description of Services Rate 1 Services by an entity registered under section 12AA of the Income-tax Act 1961 43 of 1961 by way of charitable activities. If the goods specified in this entry are supplied by a supplier along with supplies of other goods and services one of which being a taxable service specified in the entry at S. Kindly consult the professional before forming any opinion.

690E the value of supply of goods. You have to only type name or few words or products and our server will search details for you. Rate of tax is 12.

Commonly used Goods and Services at 5 Standard Goods and Services fall under 1st slab at 12 Standard Goods and Services fall under 2nd Slab at 18 and Special category of Goods and Services including luxury - 28. RATE OF GST ON SERVICES LIST OF SERVICES AT NIL RATE S. The service code for Maintenance and repair services of commercial and industrial machinery is 9987171 and the prescribed rate of GST is 18 CGST 9 of the taxable value SGST 9 of the taxable value or IGST 18 of the taxable value.

DonCallis Agra 15 May 2021. Other maintenance repair and installation except construction services are taxable 18 with Input Tax Credit. You are adviced to double check rates with GST rate.

821 satr Repair services of garments and household textiles. Tax rates are sourced from GST website and are updated from time to time. However government has exempted healthcare and educational services from the purview of the GST.

SAC Services Accounting Code are used for the identification of the service. Repair and maintenance both do not amount to manufacture. GST RATE ON SAC CODE - 995463 IS 18 Services Accounting Codes SAC Codes 995463 is used for the Heating ventilation and air conditioning equipment installation services under Goods and Service Tax classification.

GST Rate is 5 without Input tax credit. Hubcoin shall not be responsible for any damages or problem that may arise to you on relying on the above search results. Va Composite supply of works contract as defined in clause 119 of section 2 of the Central Goods and Services Tax Act 2017 other than that covered by items i ia ib ic id ie and if above supplied by way of construction erection commissioning installation completion fitting out repair maintenance.

GST rates for all HS codes. Using GST SAC code the GST rates for services are fixed in five slabs namely 0 5 12 18 and 28. Hsn code for ac repairs and services and replaces.

ATHILINGAM V accountant 12 October 2020. Can u please provide more info about your. HSN code for Ac repairs and services and gst.

Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. The rate of Service Tax was 15 whereas the rate of GST is 18. The most essential goods and services attract nil rate of GST under Exempted Categories.

42 satr Here you can search HS Code of all products we have curated list of available HS code with. ANOD PLASMA SPRAY LTD. The most essential goods and services attract nil rate of GST under Exempted Categories.

112017-Central Tax Rate dated 28th June 2017 GSR. It may be noted that in these cases liability shall be discharged by the e-commerce operator under Section 9 5 of the GST Law2017 as deemed supplier. SAC CODE - 998719.

GST rates on services comprising of 5 12 18 and 28 comes with various pros and cons for the consumers. It is a service. The Goods and Services Tax council has.

If a service is not exempted from GST or if the GST rates are not provided then the default GST rate for services of 18 would be applicable. M Venkat CA finalist 31 January 2021. Here is a case law in which it has been held that repair and maintenance do not amount to manufacture.

38 of the Table mentioned in the notification No.

Sac Codes Gst Rates For Services In India Indiafilings

List Of Taxes Replaced By Gst Everything You Need To Know Abc Of Money

Gst Rate For Authorised Service Stations For Motor Vehicles Servicing Or Repairs

Gst Rate Changes For The Year 2020 2021 Vakilsearch

Should You Think For An Ac Upgrade Or Not Ac Repair Air Conditioning System Inventory Management Software

A Online Indian Gst Calculator To Calculate How Much Your Products And Or Services Would Cost After The Application Of Gst Coding Goods Services India

Maintenance Repair And Installation Under Gst

Gst Tariff For Maintenance Or Repair Services

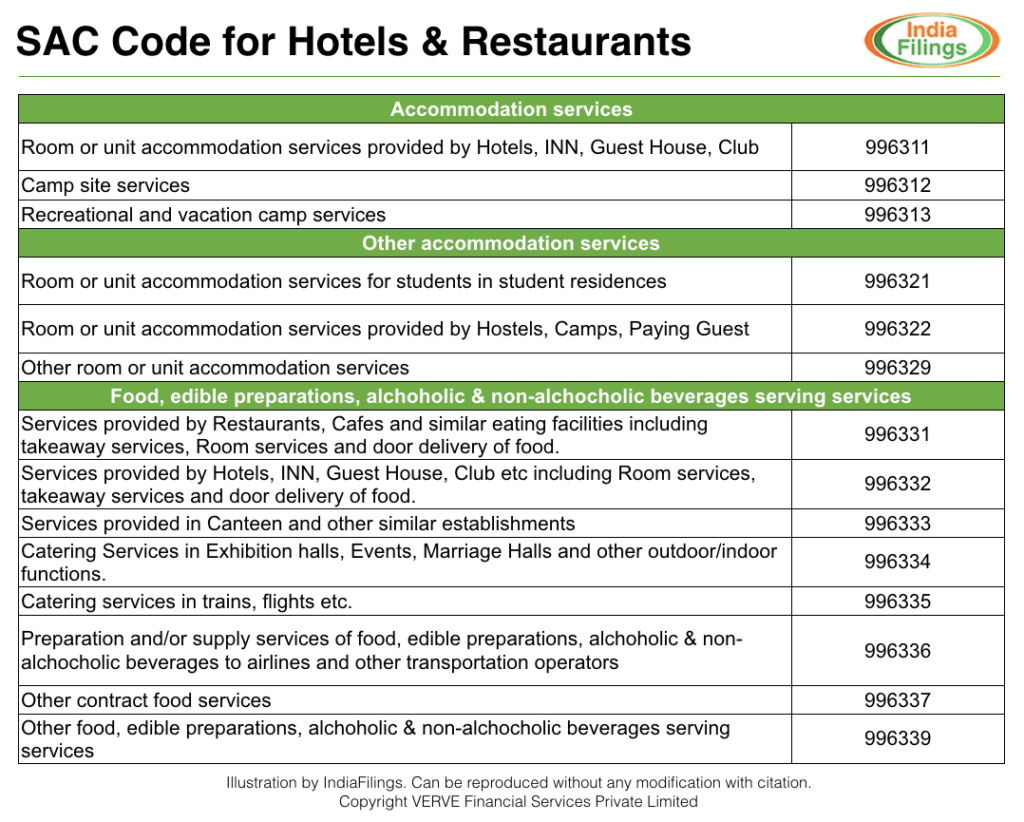

Gst On Hotels And Restaurants Indiafilings

Gst Some Items To Be Cheaper Nation The Star Online Air Conditioning Repair Good And Cheap Repair

Top 20 Aircon Servicing Singapore Companies Aircon Air Conditioner Service Air Conditioner Units

Supply Of Air Conditioners With Installation Services Is Chargeable With 28 Gst Faceless Compliance

Construction Services Under Gst

Gst Air Conditioning Repair Good And Cheap Repair

Purchase And Sales Return Under Gst

Meaning Of Sgst Igst Cgst With Input Tax Credit Adjustment Sag Infotech

Post a Comment for "Gst Rate On Ac Repair Service"